Insurance

Tech Custom Software

Enterprise Data Warehouse Infrastructure & Management, Custom Reporting & Dashboards, and Audit Support for Insurance Carriers.

Simplifying Data Management and Compliance Reporting for Insurance Carriers

Sparkfish provides the expertise necessary to tackle complex software and data management challenges. Our goal is to find the best path to solving complex problems.

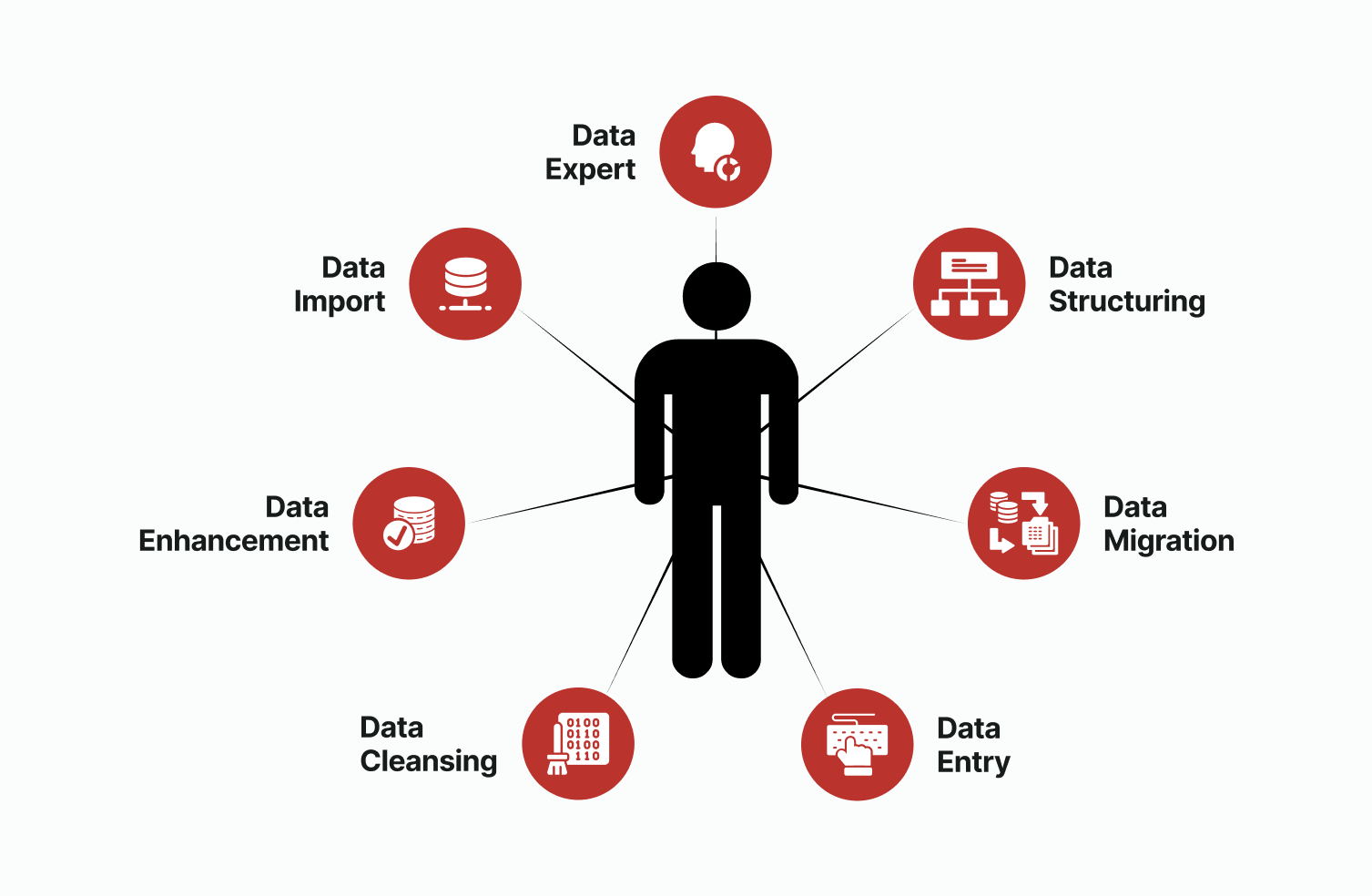

How We Can Help

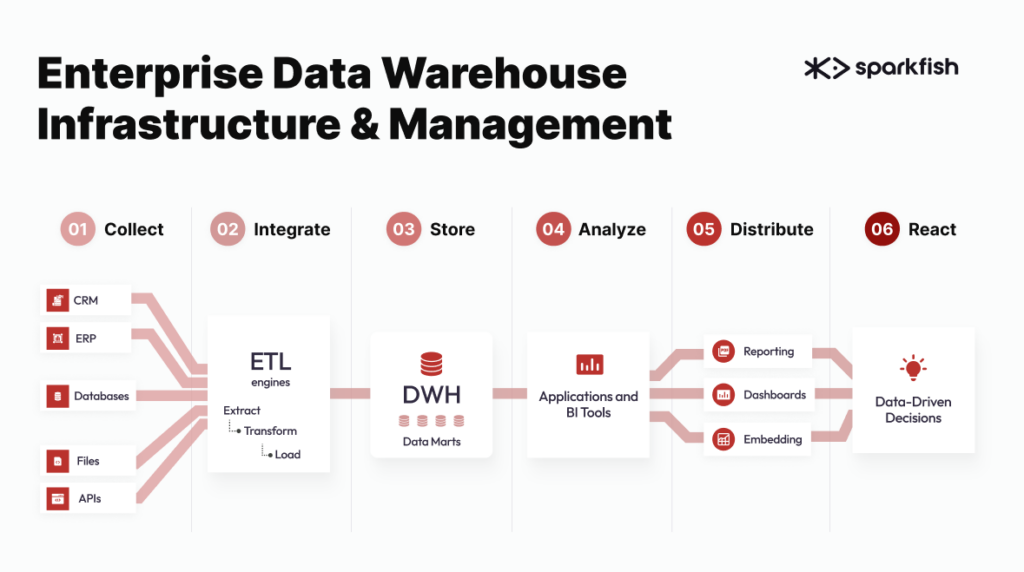

With data being consumed from hundreds of different sources, we worked with our client (an Insurance Carrier) to create a Data Warehouse that includes file verification and data integrity validation as part of the ETL process. These new processes have allowed users a granular view of their data, dramatically improving their reporting, reducing their risk and increasing profits.

Solving Complex Software & Data Challenges

What Others Have To Say

FAQ

Insurance Technology Services

Data Management refers to the process of organizing, storing, protecting, and maintaining the data generated and used by an organization. This includes data collection, processing, analysis, distribution, and preservation.

Data Warehousing, on the other hand, refers to the process of collecting and storing data from different sources into a centralized repository for the purpose of analysis and decision-making. A data warehouse typically contains historical data that has been cleaned, transformed, and integrated from multiple sources, and organized in a way that supports efficient querying and analysis.

Data Management and Warehousing are closely related, as data management practices are necessary to maintain the integrity and quality of data in a data warehouse. A well-designed data warehouse can provide organizations with valuable insights into their operations, customers, and markets, helping them make better-informed decisions.

Compliance and Actuarial Reporting Support refers to the services and assistance provided by professionals to ensure that a company is compliant with regulatory requirements and accounting standards related to actuarial reporting. These services are typically provided by compliance experts and actuaries, who work closely with companies to help them comply with various regulations and guidelines.

Compliance support involves ensuring that a company is following all applicable laws, regulations, and guidelines related to its business operations. This can include regulatory compliance related to data privacy, financial reporting, and other areas that are specific to the industry in which the company operates. Compliance professionals work with companies to assess their compliance risks, develop policies and procedures to mitigate those risks, and monitor compliance on an ongoing basis.

Actuarial reporting support involves ensuring that a company’s financial statements accurately reflect the value of its assets and liabilities, as well as its overall financial performance. Actuaries use statistical models and other tools to estimate future financial risks and develop strategies to manage those risks. Actuarial reporting is a critical component of financial reporting, and companies must comply with specific accounting standards related to actuarial reporting.

Together, compliance and actuarial reporting support help companies meet regulatory requirements, manage financial risks, and maintain the trust of their stakeholders.

A submission structure refers to the organization and format of a document or piece of work that is being submitted for review or evaluation. It includes the various sections, headings, and formatting requirements that are necessary to ensure that the document meets the criteria and standards set by the recipient or reviewing party.

Submission structures can vary depending on the context and purpose of the submission.

It’s important to adhere to the submission structure provided by the reviewing party to ensure that the document is properly evaluated and considered. In some cases, failure to follow the submission structure may result in rejection or a lower evaluation score.

Cash flow modeling is a financial analysis technique that involves projecting the inflow and outflow of cash in a business over a specific period of time. This is typically done using spreadsheets or specialized financial software.

Cash flow modeling can help individuals and businesses better understand their cash flow, which is the amount of money moving in and out of their bank account over a given period of time. This includes cash received from sales, investments, and financing activities, as well as cash paid for expenses, purchases, and other costs.

By analyzing cash flow data, individuals and businesses can make informed decisions about how to manage their finances, including how to allocate resources, reduce costs, and optimize their cash flow to meet their financial goals. Cash flow modeling is particularly useful for businesses when creating budgets, forecasting future cash flows, and planning for capital expenditures or debt repayment.